Canada Emergency Subsidies

** All Emergency Subsidy Programs have ended, effective May 2022 **

The Federal government has aligned emergency subsidy programs to support businesses negatively impacted by the COVID-19 pandemic. The programs' eligibility, subsidy rate structure and calculation of revenues mirror each other to be simpler for affected qualifying organizations. Canada has a short questionnaire to help businesses determine their eligibility.

As of October 2021, both CEWS and CERS have ended. The latest date to file a claim with these programs is April 21, 2022. In place of these subsidies the government has more targeted subsidies for hard hit business and businesses that operate in the tourism and hospitality industries, in addition to the Hiring Program. Below is a brief summary of each with links to the government's web page, followed by details and rates for each program.

- The

Canada Recovery Hiring Program (CRHP)

reimburses eligible employers who have experienced a revenue decline of at least 10% a portion of incremental remuneration paid to employees who were newly hired, had increased hours or increased wages in the eligible claim period.

- The

Local Lockdown Benefit provides businesses that face temporary new local lockdowns up to the maximum amount available through the wage and rent subsidy programs. From December 19, 2021 to February 12, 2022 it is expanded to included businesses subject to capacity restrictions and with a monthly revenue decrease of at least 25%.

- The

Tourism and Hospitality Recovery Program (THRP)

reimburses

hotels, tour operators, travel agencies, and restaurants for eligible wage and rent costs if they have a 12 month average revenue drop from March 2020 to February 2021 of at least 40%, and have a claim period revenue drop of at least 40%. In addition, more than 50% of revenue must come from tourism, hospitality, arts, entertainment, or recreation activities.

- The

Hardest-Hit Business Recovery Program (HHBRP)

reimburses employers for eligible wage and rent costs if they have a 12 month average revenue drop from March 2020 to February 2021 of at least 50%, and have a claim period revenue drop of at least 50%.

- The

Canada Emergency Wage Subsidy (CEWS)

reimburses eligible employers a portion of employee wages from March 15, 2020 and until October 23, 2021. The program has been expanded and extended several times, with multiple phases. It is divided into periods of four weeks each and the deadline for application is 180 days after the end of the qualifying period.

* The higher of CEWS or CRHP could be claimed for a particular qualifying period, but not both. - The Canada Emergency Rent Subsidy (CERS) subsidizes a percentage of rent and property expenses from September 27, 2020 until October 23, 2021 for qualifying organizations. It is provided directly to tenants or landlords that either have non-arm’s length rental income or mortgage interest, property tax, and insurance costs of a property owned used in an active business in Canada.

- If an organization has been temporarily shut down by a mandatory public health order issued by a qualifying public health authority, an additional

Lockdown Support of 25% of rent and certain property expenses could be subsidized.

Applications are made through CRA My Business Account or Represent a Client.

Ward & Uptigrove has a team focused on helping our clients with their applications. For inquiries, please contact your Accountant or info@w-u.on.ca.

Eligibility

All employers, including trusts, are eligible, with the exception of public sector entities. Amalgamated corporations will be deemed the same corporation. For the CRHP, the corporation must be a Canadian controlled private corporation (CCPC) to be eligible.

For CEWS and CRHP, eligible businesses must be registered for payroll on March 15, 2020 with CRA in order to qualify.

For CERS, eligible businesses must be registered for payroll on March 15, 2020 with CRA in order to qualify OR have a business number as of September 27, 2020. Eligible expenses for a location would include commercial rent paid or payable, property taxes, property insurance and interest on commercial mortgages for a qualifying property under agreements in writing entered into before October 9, 2020, less any subleasing revenues. If you have not paid the amounts due for your eligible expenses yet, you must attest (confirm) that these amounts will be paid within 60 days of receiving your rent subsidy payment. Eligible expenses are capped at $75,000 per location and $300,000 among affiliated entities per claim period. Payments made between non-arm’s length entities are not eligible expenses.

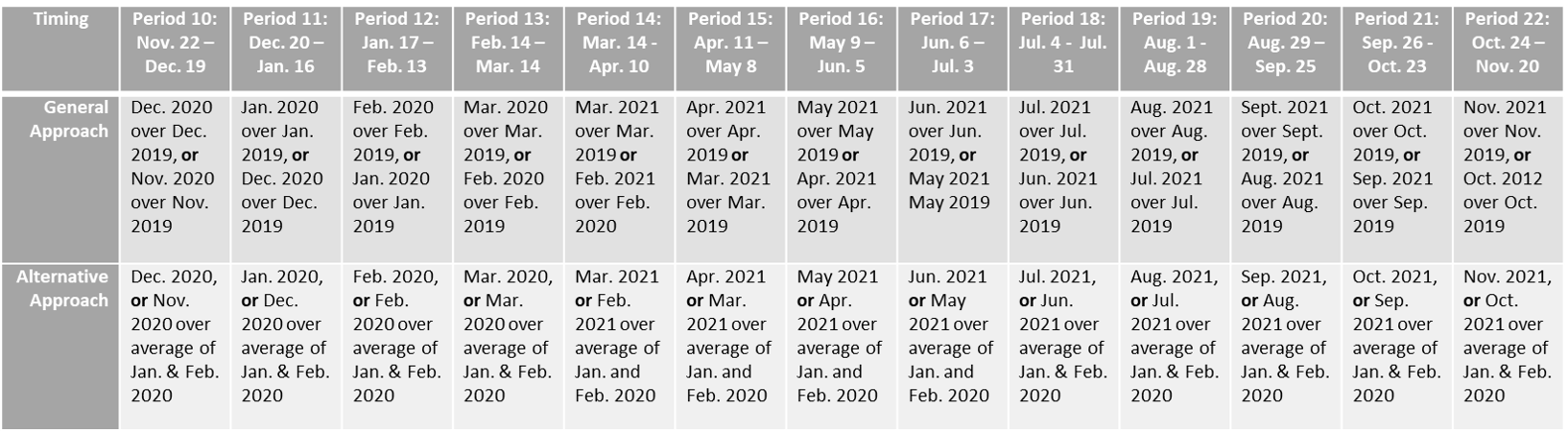

Revenue Decline & Reference Periods

All entities (regardless of what they ordinarily used) may elect to use the cash method or accrual method to determine their monthly revenue. Not for profit organizations and charities will be able to choose to include or exclude government funding in their revenue reduction test.

An employer will have the option to choose the greater of the percentage revenue decline in the current period and that in the previous period. The revenue excludes non-arm’s length sources, extraordinary items and amounts on account of capital.

Period 21 is the final CEWS and CERS periods. CRHP begins in Period 17 and continues until May 7, 2022.

Canada Recovery Hiring Program

Current Periods

The Canada Recovery Hiring Program (CRHP) requirements and eligibility mirror the Canada Emergency Wage Subsidy (CEWS). If an employer is eligible for the CEWS they will also be eligible for the CRHP, and can choose to apply for the program that provides the greater overall subsidy.

Incremental remuneration paid to employees who were newly hired, had increased hours or increased wages is reimbursed to employers at the following rates:

- 50% of the incremental remuneration paid to eligible employees between June 6, 2021 and August 28, 2021 (Periods 17 -19)

- 40% of the incremental remuneration paid to eligible employees between August 29, 2021 and September 25, 2021 (Period 20)

- 30% of the incremental remuneration paid to eligible employees between September 26, 2021 and October 23, 2021 (Period 21)

- 50% of the incremental remuneration paid to eligible employees between October 24, 2021 and November 20, 2021 (Period 22) and all periods until period 28 (May 7, 2022)

For the qualifying period between June 6 and July 3, 2021 (Period 17), the decline of monthly revenue would have to be greater than 0%. For later periods, the decline of monthly revenue must be greater than 10%. The incremental remuneration paid in these periods is compared to the eligible remuneration paid between March 14 and April 10, 2021 (CEWS period 14) for all CRHP periods. This is considered the baseline period.

The CRHP is calculated as follows:

- Total amount paid in the claim period to eligible employees, limited to $1,129 per employee per week

- Less the amount paid in the baseline period of March 14 to April 10, 2021 to eligible employees, limited to $1,129 per employee per week

- Multiplied by the CRHP subsidy rate, which is 50% for periods 17 to 19, 40% for period 20, 30% for period 21 and 20% for period 22.

The Canada Revenue Agency has released an online calculator or an excel spreadsheet to assist businesses with the calculations.

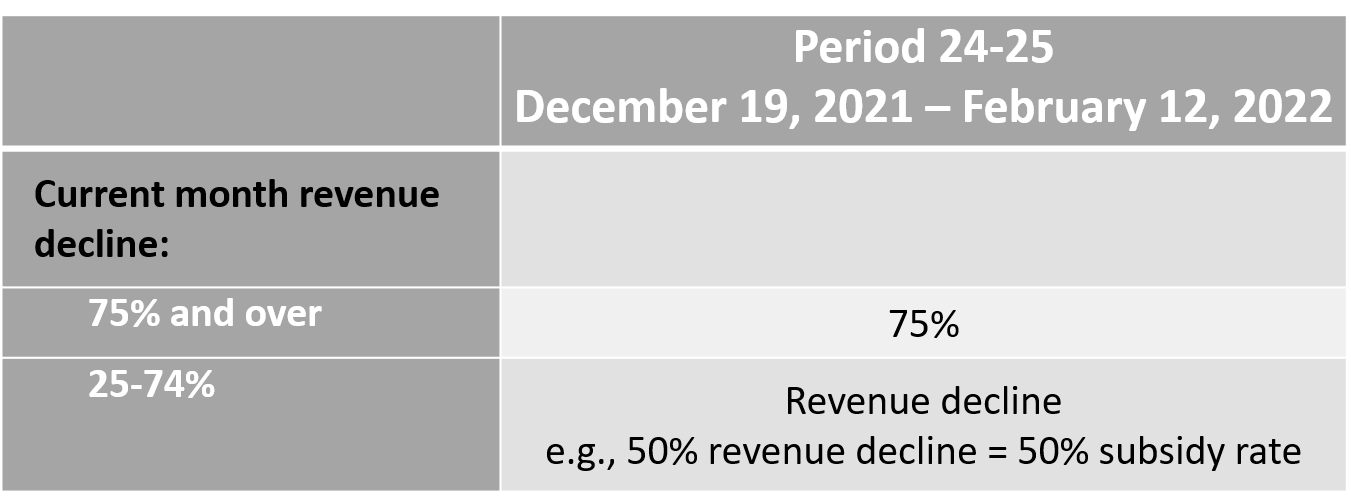

Local Lockdown Program

Program to provide businesses that face temporary new local lockdowns up to the maximum amount available through the wage and rent subsidy programs. This program is being temporarily expanded from December 19, 2021 to February 12, 2022 for businesses with a monthly revenue loss of at least 25% and to include

- a business has one or more locations subject to public health order that reduces its capacity by 50% or more.

- a business whose activities are restricted by the public health order accounted for at least 50% of its revenue during the reference period.

Wage and Rent Subsidy Rate Structure

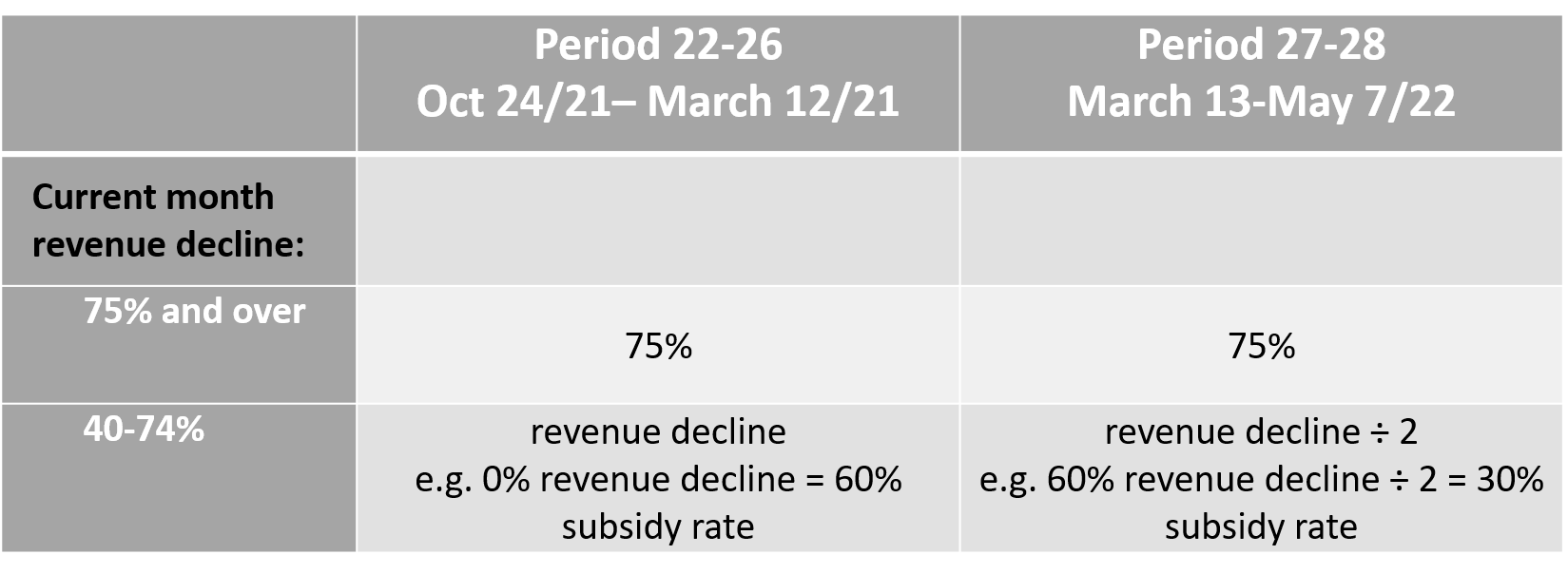

Tourism and Hospitality Recovery Program

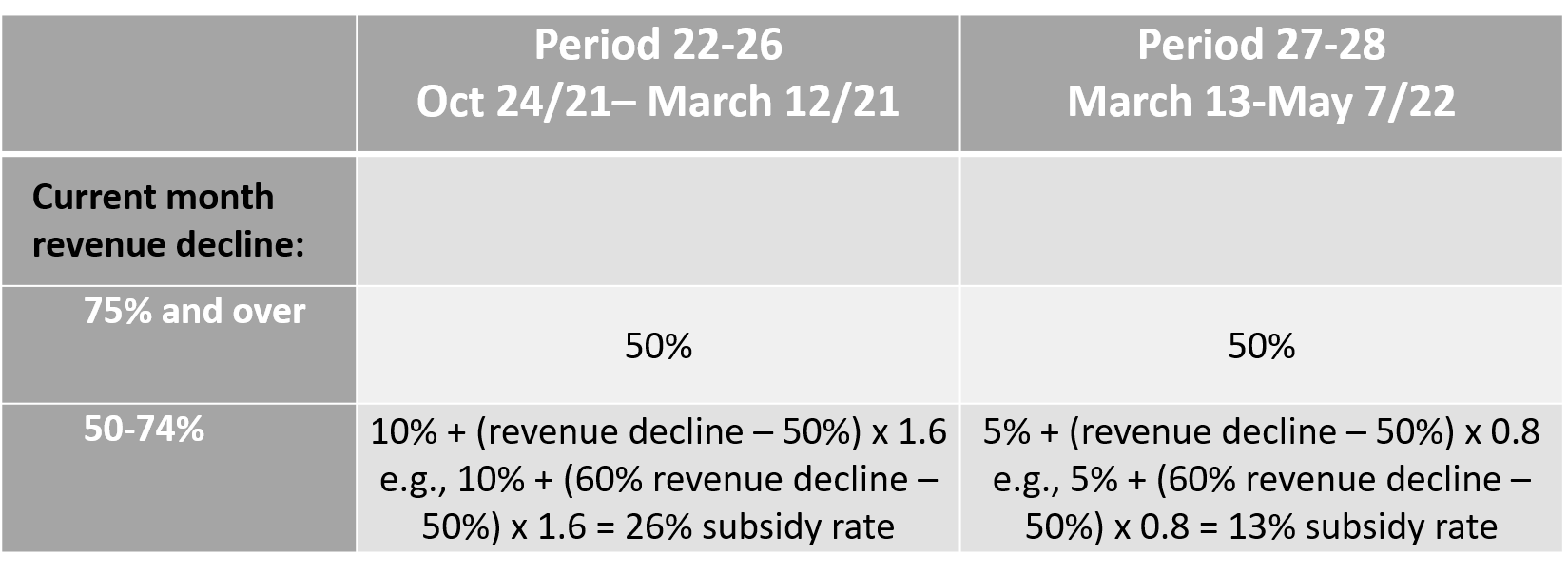

Hardest-Hit Business Recovery Program

Canada Emergency Wage Subsidy

Current Periods

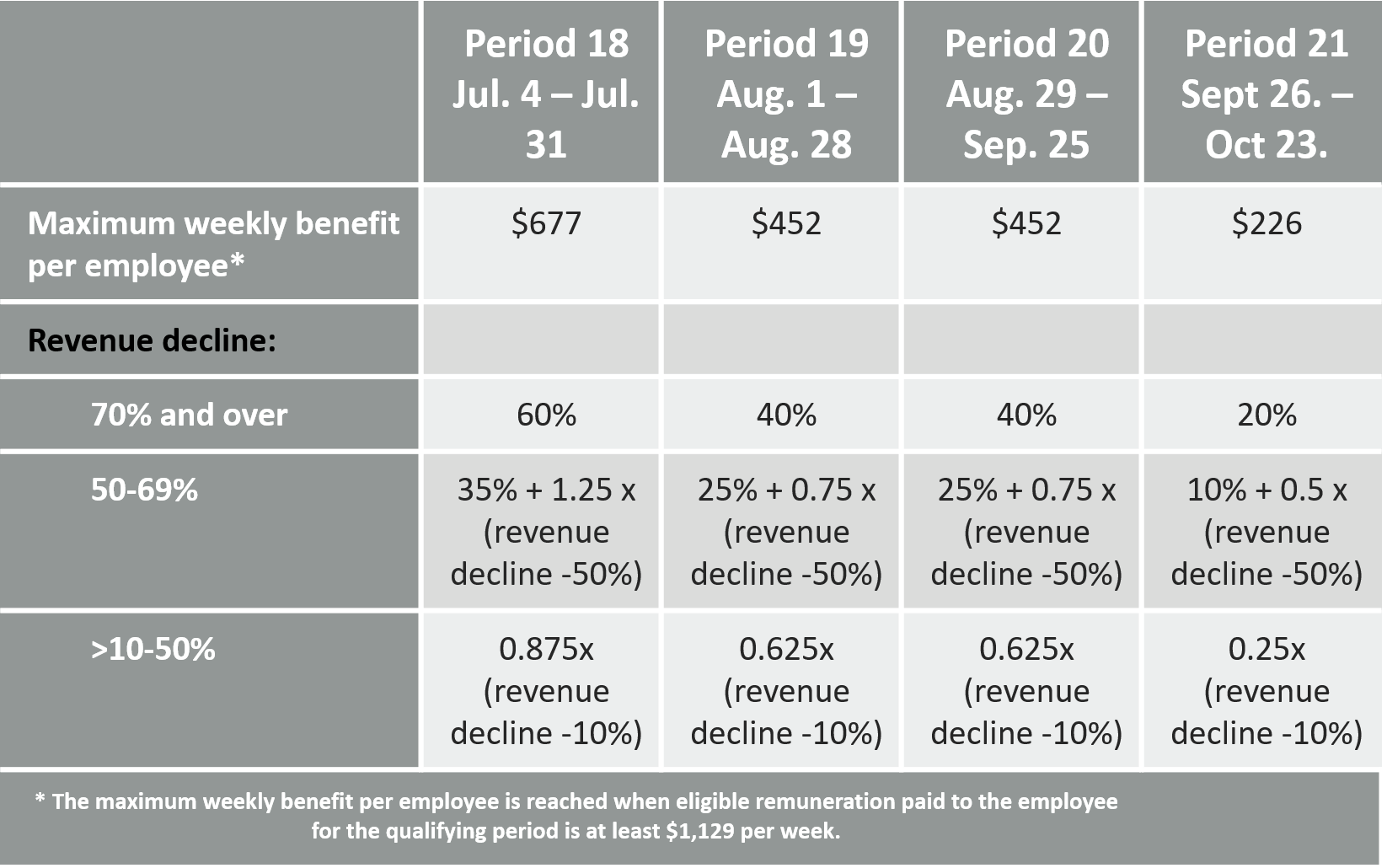

July 4, 2021 through October 23, 2021

Periods 18 through 21

Benefits will begin to phase out in these periods, with only employers that have a revenue decline of greater than 10%.

The rates and limits for CEWS are as follows

For furloughed employees, the rate structure would continue to be aligned with the EI benefits available and available to eligible employers until August 28, 2021. For furloughed employees, the weekly wage subsidy will be the lesser of the amount of eligible remuneration paid in respect of the week and the greater of $500 and 55% of pre-crises remuneration, up to a maximum subsidy amount of $595.

Canada Emergency Rent Subsidy

Current Periods

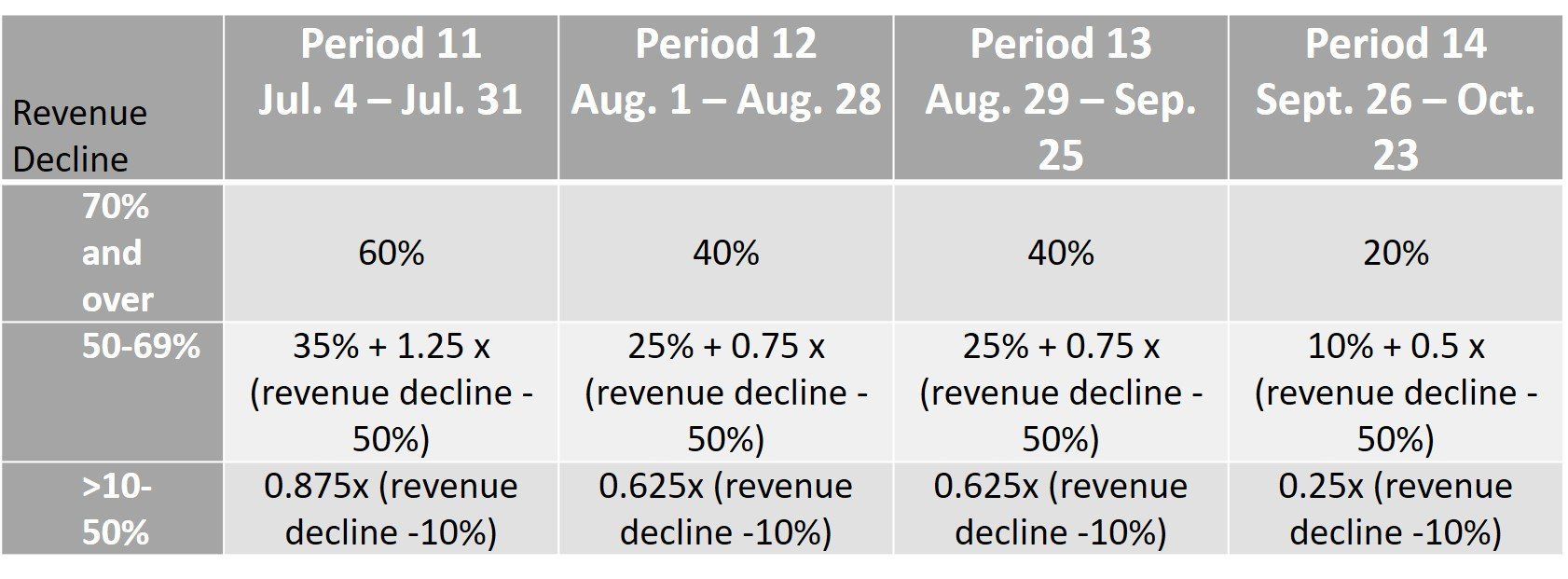

July 4, 2021 through October 23, 2021

Periods 11 through 14

Benefits will phase out in these periods, with only employers that have more than a 10% revenue decline eligible.

The rates and limits are as follows:

Lockdown support applies for all CERS periods at a 25% rate. To qualify for the Lockdown support, the location must have been closed or significantly reduced due to a COVID-19 related public health order for 1 week or longer.