IAIC Market Update - April 10, 2023

Last Week in the Markets: April 3rd – 7th, 2023*

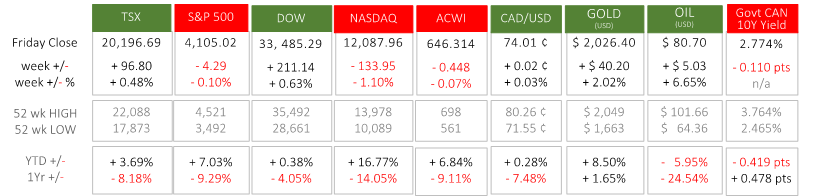

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

*TSX, S&P500, Dow and NASDAQ, Govt CAN bond closing figures as of April 6, 2023 due to exchange closures on Good Friday, April 7th

What happened last week?

- The week concluded with the closure of North American exchanges for Good Friday observances. While markets were closed, the latest U.S. employment numbers were released by the Bureau of Labor Statistics. The unemployment rate remained unchanged as 236,000 jobs were added, which is close to estimates, but well below the 326,000 jobs added in February. It is also the lowest monthly gain in jobs since December 2020. Leisure and hospitality, government and professional, business services and healthcare sectors contributed to the majority of the gains.

- Prior to the jobs announcement the major indexes delivered mixed results with the TSX and Dow advancing by ½%, the NASDAQ losing 1% and the S&P 500 essentially breaking even during four days of trading. Since the beginning of 2023 these indexes are all in positive territory with NASDAQ leading the pack at nearly 17%, trailed by the S&P 500 at 7%, the TSX at 3½% and the Dow with a slight gain. The technology-heavy NASDAQ also leads in 1-year losses at minus 14%, with the other indexes also needing to gain significantly to erase losses suffered over the past year after losing 8%, 9% and 4% for the TSX, S&P500 and Dow, respectively.

- The near-term prospects for equities will hinge on the inflation, associated interest rate and monetary policy action, and the fear of a recession from the slowing economic activity.

Source:

Bureau of Labor Statistics,

CNBC and Jobs

What’s ahead for this week?

- In Canada, an interest rate decision, monetary policy report and rate statement is scheduled for Wednesday morning from the Bank of Canada. Tiff Macklem, Bank of Canada Governor, has previously indicated that the central bank plans to pause interest rate increases.

- In the U.S., wholesale inventories and trade sales, mortgage market indexes, and fuel inventories (heating oil, gasoline, crude oil) precede inflation reports. On Wednesday the Consumer Price Index (CPI) will be released, Thursday brings the Producer Price Index and Friday includes the Import and Export Price Indexes.

- Globally, the International Monetary Fund (IMF) will conduct a series of meetings. Retail sales and industrial production will be released for the Eurozone. China will report its consumer inflation and Japan will release its producer inflation next week, providing a glimpse of price increases and, perhaps, upcoming monetary policy in Asia.

Source:

Tiff Macklem previous statement

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.