IAIC Market Update - April 19, 2021

Last Week in the Markets: April 12th - 16th, 2021

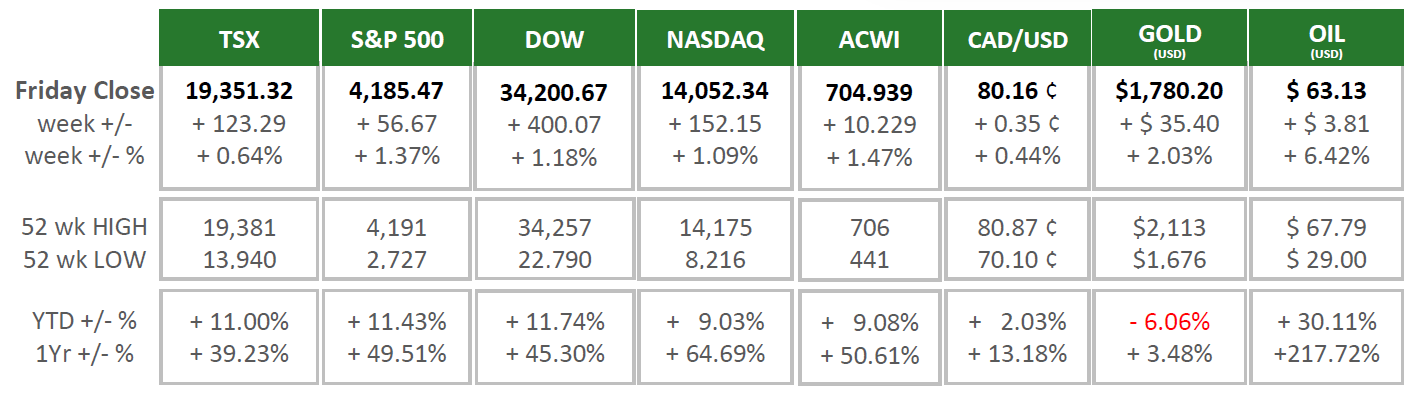

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Equity indices reached new record levels again last week. Driven by strong economic data and falling government bond yields in the U.S. the TSX, Dow and S&P 500 reached all-time highs.

- The world’s two largest economies, America and China, are growing at accelerating rates based on recently released data for Gross Domestic Product, employment, consumer confidence and spending.

- Despite the good news, the U.S. dollar fell against foreign currencies since it is generally corelated with its falling bond yields. The falling dollar led to a rise in commodity prices, like gold and oil in our grid above. However, another bellwether of the U.S. economy’s health is the earnings reported by banks. They have exceeded expectations and are 60%-250% ahead of last year. Reserves set aside for loan losses have been larger than necessary and reversing these allowances have led to stronger profits. (Source)

- Here at home, the TSX was pushed higher by developments in the U.S. and China, which have a strong influence over our economy’s ability to grow. Another contributor was the Bank of Canada (BoC) releasing its quarterly Business Outlook, which achieved its highest level since 2018. Demand is increasing and high-contact industries continue to struggle. (Source)

What’s ahead for this week?

- In Canada, the schedule includes the release of March housing starts and new housing price index, manufacturing sales and inflation through the Consumer Price Index (CPI).

- The Bank of Canada will release its policy announcement and monetary policy report on Wednesday.

- The Liberal government will release the federal budget this week, which is scheduled for Monday.

- In the U.S., new and existing home sales for March is scheduled. Markit Purchasing Managers Indices (PMI) will show corporate confidence for expansion. A number of large industrials will release their latest earnings reports, including United, American and Southwest Airlines, Coca-Cola, IBM, P&G, J&J, Netflix, AT&T, American Express, Travelers, Kimberly-Clark, CSX, Xerox.

- Globally, Japan releases its March trade surplus and February industrial production, along with its PMI and inflation numbers. The European Central Bank (ECB) holds its policy meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.