IAIC Market Update - August 30, 2021

Last Week in the Markets: August 23rd - 27th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

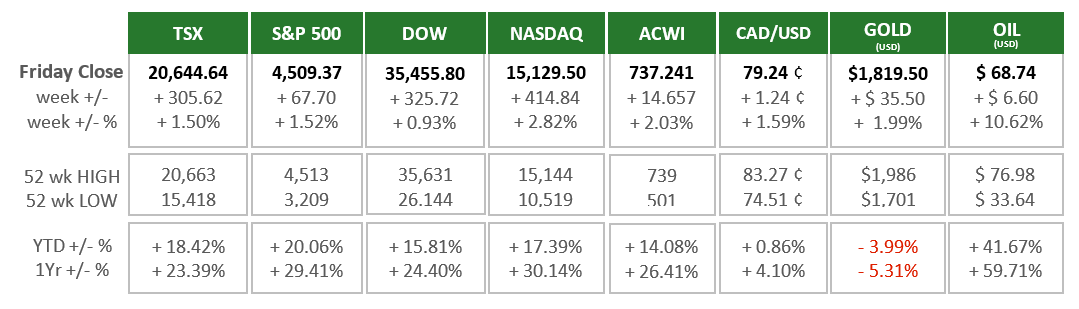

- Last week produced another all-green week for our grid, above.

- A primary driver in the rise of equities last week was the announcement on Friday by the Chair of the Federal Reserve, Jerome Powell, at the conclusion of the annual Jackson Hole Symposium. Some changes are on the horizon for monetary policy but are not imminent. The Fed’s current program of buying $120 Billion in bonds each month, which injects liquidity into capital markets, will likely be “tapered” by the end of 2021. The liquidity (along with low interest rates) encourages personal and corporate borrowing to fuel economic growth.

- Secondarily, the need to temper inflation with an interest rate increase is being handled with extreme care. The major concern is that a rate rise now will cause lasting damage to a temporary, pandemic-recovery related period of price increases. The need to act is reduced because inflation is limited to a narrow band of goods and services, the areas with the highest inflation are moderating, and wages are not positioned to support further inflation growth. (Source)

- After hitting an 8-month low on August 20th, the Canadian dollar has risen sharply; 1.6% last week and outpaced the TSX’s 1.5% gain. The TSX relied heavily on the results of the major banks who bested profit expectations based on reduced loan-loss provisions and increasing retail banking performance. The banks’ collective performance of quarterly profit above $15 Billion caused Prime Minister Trudeau to propose increased taxation. (Source)

What’s ahead for this week?

- In Canada, real Gross Domestic Product (GDP), for the second quarter, is scheduled for release along with July’s trade balance, labour productivity and building permits.

- In the U.S., pending home sales, construction spending, goods and services trade balance and factory orders will be announced. The most important data, especially affecting monetary policy, on the schedule is August employment numbers, which includes labour force participation and unemployment. A number of Purchasing Managers Indices (PMI) will also be released by Markit and ISM.

- Globally, Japan retail sales, industrial production, unemployment and consumer confidence will be released. Eurozone inflation, Germany consumer inflation U.K. markets are closed for the Summer Bank Holiday.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.

CONTACT US

Ward & Uptigrove