IAIC Market Update - December 13, 2021

Last Week in the Markets: December 3rd - 10th, 2021

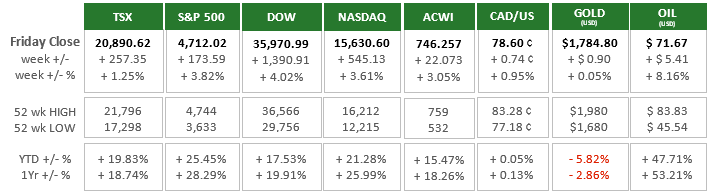

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The Bank of Canada announced its latest monetary policy on Wednesday keeping the three key short-term interest rates unchanged; Overnight Rate and Deposit Rate sit at ¼% and the Bank Rate stays at ½%. This stay-the-course inaction was expected based on the Bank’s previous guidance. However, the comments that accompanied maintenance of current interest rate levels indicated that increases cannot be avoided indefinitely. Inflation is running well above the desired level in Canada, Gross Domestic Product is approaching pre-pandemic levels after strong third-quarter growth, and economic momentum appears strong with job gains bringing the level of employment close to February of 2020. These factors were explicitly stated in the Bank’s announcement along with the projection that the Bank of Canada will continue to support economic recovery with low interest rates. The support could begin to be lessened by an increase in short term rates “sometime in the middle quarters of 2022.” (Source)

- The U.S. Federal Reserve will release its monetary policy update on Wednesday, December 15th.

- The other major announcement from this past week was the Consumer Price Index (CPI) in the U.S., which showed that prices have risen 6.8% overall in the last year. Prices were up 0.8% in November after a 0.9% increase in October. This is the highest rate of inflation since 1982. The core inflation rate is 4.9%, and “the price indexes for gasoline, shelter, food, used cars and trucks, and new vehicles were among the larger contributors” according to the Bureau of Labor Statistics. (Source)

What’s ahead for this week?

- In Canada, November’s industrial product price index, housing starts, existing home sales, and inflation through the Consumer Price Index will be released.

- In the U.S., the Producer Price Index, retail sales, import prices, housing starts and building permits for November are scheduled. Also, the Federal Reserve’s latest monetary policy announcement and economic projections is on the calendar for Wednesday afternoon.

- Globally, industrial production, trade balance and Purchasing Managers Indices from Japan, China and Eurozone will be announced. Mirroring the U.S. the European Central Bank will conduct their monetary policy meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.