IAIC Market Update - July 19, 2021

Last Week in the Markets: July 12th - July 16th, 2021

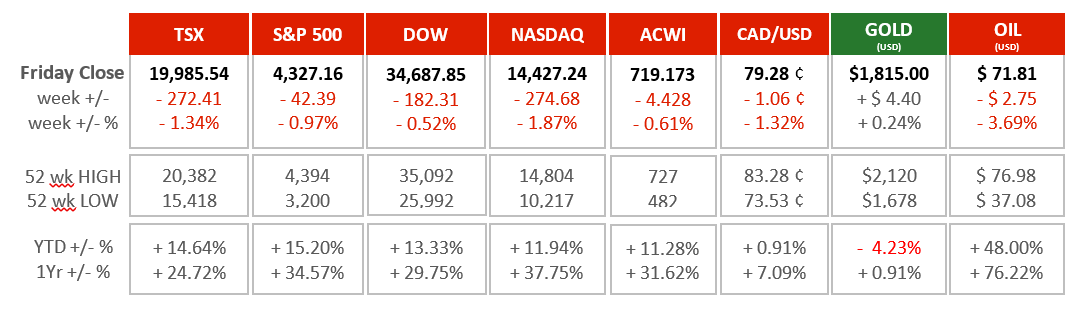

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- On Wednesday the Bank of Canada held its benchmark interest rate unchanged at ¼%, as the country and world continue to emerge from the pandemic. The central bank does not expect to raise rates until the second half of 2022 at the earliest, even as variants of concern continue to rise and virus containment is not universal.

- The two themes discussed in detail at the press conference were increased confidence and continued attention. Governor, Tiff Macklem, mentioned falling case counts, progress on vaccinations and easing measures as evidence of recovery and an expectation for its continued momentum. Also, on-going scrutiny must be applied to the “dynamics of recovery and inflation”.

- As expansion continues, the Bank’s forecast for inflation has been increased. Bank of Canada economists believe that the rate will be above 3% for the balance of 2021, before nearing the Bank’s target of 2% during 2022, rise again in 2023 and then back to 2% in 2024. The belief is that pent-up demand is outstripping decreased supply temporarily. When supply rebounds inflation is expected to slow, and more typical price increases will return.

- American consumer inflation rose to 5.4% in June, the highest year-over-year price increase for a month since 2008 during the financial crisis. Prices of goods and services fell during the early months of the pandemic, and June 2021 price spikes are being compared against the lows of June 2020. Despite the high rate of inflation, the Federal Reserve has also left rates unchanged. (Source1,

Source2,

Source3)

What’s ahead for this week?

- In Canada, it will be a light week for economic announcements with Aprils’ household credit, retail sales for May, and housing prices for June as the major announcements.

- In the U.S., housing starts, new house prices, existing home sales are scheduled for announcement. Also, the Purchasing Managers Indices from Markit for the month of July will be released.

- Globally, the light week for economic news continues. The major releases on the calendar are Japan’s inflation numbers and trade balance, and the Eurozone’s consumer confidence. On Thursday the European Central Bank will conduct a Monetary Policy Meeting that will discuss the effects of the pandemic, the recovery, the vaccination program and recent weather events on the region’s economy.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.