IAIC Market Update - June 5, 2023

Last Week in the Markets: May 29th – June 2nd, 2023

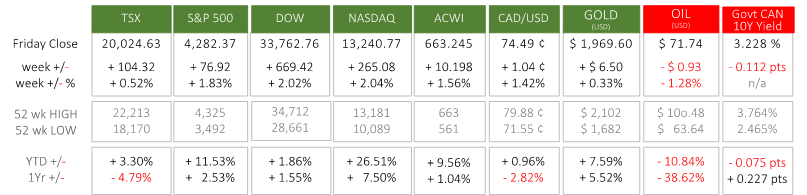

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- U.S. markets were closed on Monday for Memorial Day, but that did not stop equities from receiving a much-needed boost as May concluded and June began. The surprising laggard among North American equity indexes was the NSADAQ that gained only 1% on Friday, while the others rose 1½ to 2%. Both the TSX and the S&P 500 had been down for the week until Friday’s rally. So far this year and over the past year the NASDAQ has delivered the highest returns of the major indexes.

- Avoiding a default on U.S. government debt was a leading reason for wide-spread growth in share values last week. A deal had been agreed between House Leader McCarthy and President Biden prior to Monday’s Memorial Day. Despite deep criticism from both Democrats and Republicans, it received bi-partisan approval in the House and the Senate and was then signed into law. A 2-year extension on the debt ceiling was achieved in exchange for spending and taxation reductions.

- Secondly, on Friday morning, the latest U.S. jobs data was announced. Employment grew by 339,000 in May, and the unemployment rate rose 0.3% to 3.7% as the number of unemployed persons grew by 440,000 to 6.1 million.

- The on-going growth in jobs in Canada and the U.S. has confounded the Bank of Canada and Federal Reserve. Increasing interest rates to lower demand is less effective when job growth is robust. Jobs growth makes a recession less likely but could lead to additional interest rate increases to slow inflation.

Source: Debt Ceiling Agreement, Employment Situation Summary

What’s ahead for this week?

- In Canada, the most significant news will likely arrive from the Bank of Canada when it announces its latest interest rates on Wednesday morning. A pause in rate hikes has been in-place, and the mid-week release will demonstrate whether The Bank believes that it has struck the right balance between slowing demand-fueled inflation, but not slowing the economy into recession. Friday’s employment numbers will also provide insight into the health of the Canadian economy.

- In the U.S., durable goods, factory orders, mortgage market index, wholesale sales and inventories will be released. On June 14th the Federal Reserve is scheduled to release its next interest rate announcement, and it will be heavily anticipated and closely watched since its influence on markets could be very strong.

- Globally, the Eurozone will report its retail sales, imports, exports and trade balance and employment, unemployment, and wages. China will report consumer inflation and employment data.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.