IAIC Market Update - March 20, 2023

Last Week in the Markets: March 13th – 17th, 2023

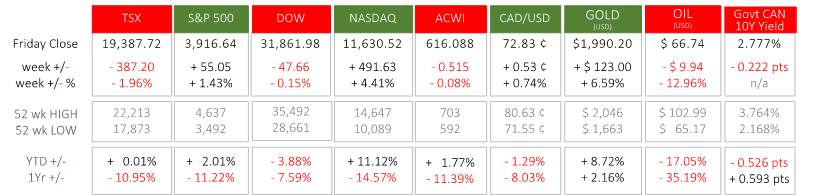

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Friday’s St. Patrick’s Day celebration coincided with the ending of about ten days of market turmoil. The widely varying opinions of the significance for investors of recent events had the North American indexes reflecting the same lack of clarity. The NASDAQ and the Dow gained 4½ and 1½%, respectively, for the week while the TSX dropped by 2%.

- A number of important economic indicators were released, but fears over the failures of two U.S. banks, and difficulties for two more, First Republic and Credit Suisse, drove the news cycle early last week.

- The failures of Silicon Valley Bank and Signature Bank were the first since 2020, and the 512th and 513th since 2008. Elsewhere, First Republic received a capital injection of $30 Billion from other banks. On Sunday a $3.2 Billion purchase of Credit Suisse by UBS was announced.

- The European Central Bank (ECB) “decided to increase the three key ECB interest rates by 50 basis points, in line with its determination to ensure the timely return of inflation to the 2% medium-term target.”

- The U.S. Consumer Price Index (CPI) for February was released on Tuesday at 0.4% for the month and 6.0% year-over-year.

- The recent events in the financial industry that require stability measures may hamper the Fed’s ability to address inflation. The implications for the Federal Reserve’s interest rate announcement on Wednesday are being considered in light of the late Sunday sale of Credit Suisse.

Sources:

ECB,

CNBC UBS and CS,

Bureau of Labor Stats and CPI

What’s ahead for this week?

- In Canada, the consumer inflation data and new housing price index for February will be released on Tuesday morning prior to market-open.

- In the U.S., several housing indicators are scheduled for release including existing and new home sales, building permits, mortgage applications, mortgage market and refinance indexes. The most compelling release will be Wednesday’s interest rate decision from the Federal Reserve.

- Globally, consumer confidence and the trade balance for the Eurozone will be announced along with manufacturing and services Purchasing Managers Indexes for the region. In Asia, an interest rate announcement is due from the Peoples Bank of China, and Japan’s CPI are scheduled for release.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.