IAIC Market Update - November 1, 2021

Last Week in the Markets: October 25th - 29th, 2021

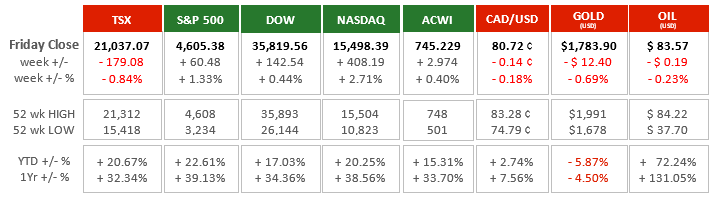

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The TSX was the only major North American equity index to lose ground last week. Even with some high-profile earnings disappointments, like Amazon and Apple, the U.S. indices including the NASDAQ, made strong gains.

- The most significant negative news for the TSX and most Canadian investors was the announcement by the Bank of Canada that their quantitative easing program of bond-buying would be ending.

- Secondarily, the forward guidance that an interest rate increase is predicted for the middle of 2022, not the end of next year, further lowered expectations.. This move and guidance are based on the growing realization that inflation in Canada (and the U.S.) is not as temporary as first suspected.

- Bond-buying can lower the long-term borrowing rate for businesses and households and may encourage and allow for major investments and purchases that contribute to economic recovery. Dialing the quantitative easing program back to zero is designed to reduce overall demand and upward price pressures, but may also cause a reduction economic growth. With the short-term rate at its lowest possible level of ¼%, the ability to spur economic growth with short term rates does not exist, so the Bank of Canada has decided to raise long-term rates now. (Source1,

Source2)

What’s ahead for this week?

- In Canada, October’s manufacturing Purchasing Managers Index (PMI) from Markit, building permits and merchandise trade balance will be released. The employment report for October is scheduled for Friday.

- In the U.S., Markit and ISM will announce their manufacturing and services PMIs, along with construction spending, factory orders. The Federal Reserve will announce its latest monetary policy following the Federal Open Market Committee’s meeting midweek.

- Globally, the Eurozone, China and Japan will release their manufacturing and services PMIs, too. Germany’s factory orders, industrial production and retail sales are on the calendar. OPEC+ will hold another meeting amid continued increases in the price of oil.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.