IAIC Market Update - November 22, 2021

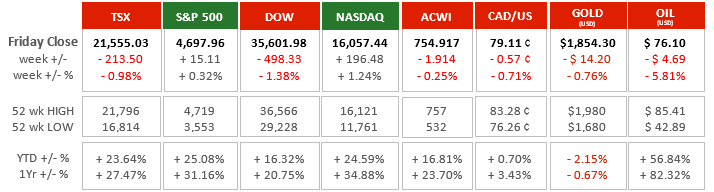

Last Week in the Markets: November 15th - 19th, 2021

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The markets were mixed with the TSX and Dow losing 1% or more while the S&P 500 and NASDAQ made gains. The drop in Canadian equites rested largely on the drop in the price of oil. Energy is the second largest sector comprising the TSX after Financials. The Canadian dollar also dropped three-quarters of a percent, magnifying the losses in Canadian dollar denominated equities.

- Much of the negative momentum was propelled, by domestic inflation as October’s Consumer Price Index rose 4.7% over the same period in 2020. Transportation costs, including gasoline, was a major contributor, however, the recent reduction in the price of oil may help. Food and housing are continuing their rise as well. Thankfully inflation is well below the U.S. rate of 6.2%, but this is the highest rate increase for Canadian prices in more than 18 years.

- The inflation rates on both sides of the border are driving increased speculation that the Bank of Canada and the Federal Reserve will act to increase their benchmark lending rates to cool inflation. Both central banks have set the average inflation target at 2%, and nearly 5% and more than 6% in Canada and the U.S., respectively, are well beyond the goal. Early analysis suggested that increased inflation rates were merely temporary as reopening expanded, but price increases are persisting and it appears that it may be well into spring of 2022 before prices become more stable. (Source)

What’s ahead for this week?

- In Canada, September’s budget balance for the federal government and October’s wholesale trade and manufacturing sales are on the economic release calendar.

- In the U.S., Thanksgiving will shorten the trading week with markets closed on Thursday. New and existing home sales, goods trade deficit, durable goods orders, personal spending and income, wholesale and retail inventories for October will be announced. Also, the Purchasing Managers Indexes (PMIs) from Markit for November and third quarter real Gross Domestic Product (GDP) will be released.

- Globally, Eurozone and Japanese PMIs that signal purchasing managers’ optimism will be released along with Germany’s consumer confidence, real GDP and business climate survey.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.