IAIC Market Update - October 17, 2022

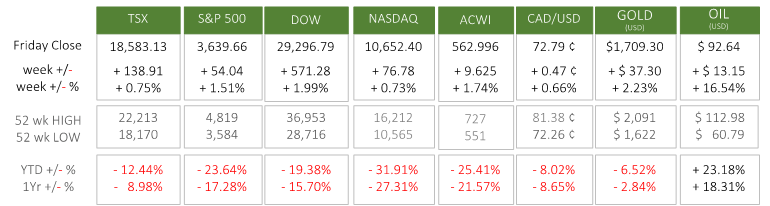

Last Week in the Markets: October 10th – 14th 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- U.S. consumer and producer inflation figures were released mid-week and immediately drove equity indexes downward. The fact that inflation increased, the size of the increase, and the continued high levels is compelling the Federal Reserve to act further with tighter monetary policy.

- The U.S. Consumer Price Index (CPI) and the Producer Price Index (PPI) each rose 0.4% in September. Prices for consumers have risen 8.2% over the past year. Although, gasoline prices fell in last month, the cost of food, natural gas, electricity rose. Core CPI that does not include volatile food and energy prices increased by 0.6% in September and sits at 6.6%. PPI, which measures inflation at the wholesale level, has risen 8.5% on a year-over-year basis. (Source1, Source2)

- Central bank “tightening” by raising interest rates and reducing bond holdings will slow the economy, and threaten corporate earnings and, therefore, erode share prices. These effects are further exacerbated by lingering supply chain issues and Russia’s continued aggression in Ukraine.

- The Fed’s quantitative tightening started in January, the war in Ukraine began in February and interest rate increases started in March by the Federal Reserve and Bank of Canada. These events triggered the first dips in North American equity indexes.

- The confirmation of continued high and increasing inflation has made another ¾% (75 basis points) increase by the Federal Reserve on November 2nd a near certainty. The negative effect on equities caused by higher interest rates should not be a surprise at this point. The reaction of an existing portfolio to the heightened rates and the further reaction to additional increases should be reviewed in the context of each investor’s unique situation. (Source)

What’s ahead for this week?

- In Canada, after last week’s release of U.S. inflation indicators, the Canadian Consumer Price Index will be announced. Building permits, housing starts, and retail sales are scheduled. Also, the Bank of Canada will release its quarterly Business Outlook Survey.

- In the U.S., September’s capacity utilization, industrial production, manufacturing, building permits, housing starts, and existing home sales will be announced.

- Globally, in another round of what has been bad news for investors the Eurozone will release its CPI for September. China will announce its retail sales imports, exports, trade balance, and house prices along with its Q3 Gross Domestic Product. Japan, the world’s third largest economy, will also release its CPI.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.