IAIC Market Update - October 18, 2021

Last Week in the Markets: October 11th - 15th, 2021

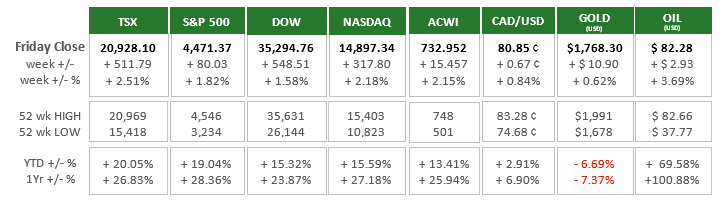

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

It was a very positive week in the markets:

- Equities rose 1.5% to 2.5% with the major indices approaching or setting new 52-week highs.

- The Canadian dollar rose along with the price of oil. Oil has doubled in the past year, which is good news for Energy investors, but will increase consumer and producer inflation.

- Gold, which gained last week, is still down more than 7% in the past year.

- The positive performance for stocks and oil was achieved despite the mixed news that was announced:

- The International Monetary Fund (IMF) released its “World Economic Outlook” with the headline “Global recovery continues, but the momentum has weakened, and uncertainty has increased”. The slowdown has been attributed in part to supply disruptions in advanced economies and worsening pandemic conditions in developing countries. (Source)

- Consumer inflation rose 5.4% in September. The Federal Reserve has been maintaining that the higher inflation rate situation is temporary. Concern is growing that inflation may not be as transitory as hoped based on recent data from the housing market.

- Expectations to taper Federal Reserve bond purchases, which would increase the cost of long-term borrowing is continuing to grow. The move to taper is being driven by increasing inflation, but also potentially delayed by stalling Gross Domestic Product and employment numbers. Based on the Fed’s announcements an increase to the benchmark interest rate is not expected until 2022 or 2023. (Source)

What’s ahead for this week?

- In Canada, September inflation through the Consumer Price Index will be released, which will heavily influence Bank of Canada actions. The central bank’s Business Outlook Survey, housing starts, manufacturing sales are all on the calendar.

- In the U.S., industrial production, capacity utilization, building permits and housing starts and existing home sales for September will be released. A number of Purchasing Managers Indexes (PMIs) that predict upcoming business and wholesale activity are also on the schedule.

- Globally, important economic indicators from China will be announced with real Gross Domestic Product, trade balance, retail sales and industrial production scheduled for announcement. Japan’s CPI and Eurozone inflation and consumer confidence will also be announced.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.