IAIC Market Update - October 4, 2021

Last Week in the Markets: September 27th - October 1st, 2021

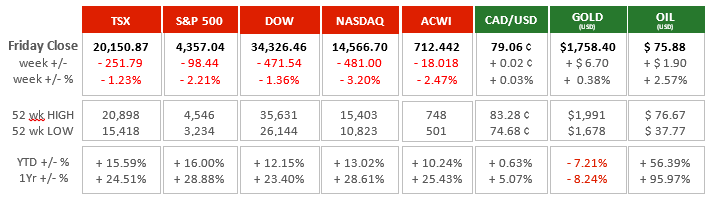

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- All of the major indices suffered losses, especially the technology-heavy NASDAQ that dropped more than 3% last week. Most of the news negatively affecting equity markets last week emanated from the U.S.

- The negotiations in Washington over the debt ceiling and the infrastructure bill dragged on past the end of the week and into the weekend.

- The House of Representatives passed measures on Thursday evening, just prior to the deadline, raising the debt ceiling until early December when the same type of posturing and politicizing will return. The threat to the AAA rating the U.S. holds for debt is threatened each time this ceiling is negotiated.

- The massive $3.5 Trillion infrastructure bill proposed by President Biden is stalled in the House and will now be discussed and debated after his social policy package is passed by the Democrat-controlled Congress.

- Progressives within the Democrat ranks have blocked approval of the infrastructure bill and have created a rift within the party as legislative delays persist.

- The Federal Reserve, and by extension the Bank of Canada, appears poised to allow long term interest rates to rise as the bond-buying measures will likely be tapered soon.

- The good news is that short-term interest rates are not expected to be changed by the Fed or other central banks soon; forecasts are placing that action about one year away.

What’s ahead for this week?

- In Canada, data will be released for building permit and trade balance for August. The September employment report will be released, where 60,000 new jobs are expected along with the unemployment rate falling to 6.9%.

- In the U.S., August wholesale trade, factory orders, trade balance, and consumer credit will be announced. Purchasing Managers Indices from ISM will be released along with the U.S. jobs report for September where nearly 500,000 new jobs are expected, and the unemployment rate should fall to 5.1%.

- Globally, markets in China will be closed until Friday to observe its National Day and Golden Week. OPEC+ will hold a meeting via videoconference. Eurozone retail sales, Germany’s factory orders, trade surplus and industrial production will also be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.