IAIC Market Update - September 6, 2022

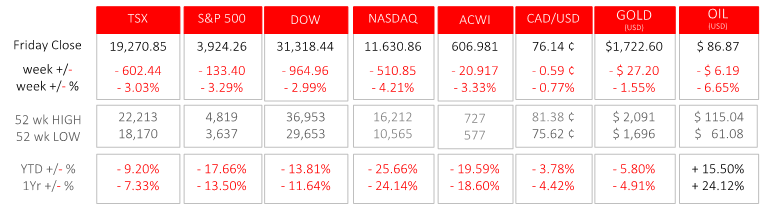

Last Week in the Markets: August 29th – September 2nd, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The reality of the inflation environment and central bank positioning continued to control equity markets last week. When Federal Reserve Chair, Jerome Powell, stated his resolve to tame inflation in his August 26th speech at the Jackson Hole Symposium, markets took notice, and continue to do so. He stated that the negative effects of long-term inflation, the accompanying instability, and the inclusion of inflationary considerations into economic decision-making by individuals and firms, will deliver far more damage than measured monetary policy. His stance to stop inflation with his central bank’s actions is firm.

- The Bank of Canada, European Central Bank and Federal Reserve will announce interest rate decisions within the next three weeks (September 7, 8 and 21, respectively), and equity markets seem to have taken Powell at his word. North American indexes have reacted with an uptick in volatility and sizeable overall losses. Last week was the second consecutive week that American stocks lost 4%, while the TSX has dropped less at 1 and 3 % for the last two weeks.

- The U.S. labour market continued its strong performance as 315,000 jobs were added in August. The unemployment rate rose 0.2% to 3.7%, which is still below February 2020 levels. The rise in the unemployment rate was partially driven by an increase in the Labour Force Participation Rate. (Source)

- Canada’s economic health represented by Gross Domestic Product (GDP) rose 0.1% in July, 0.8% during the second quarter and at an annual rate of 3.3%. This was the fourth consecutive quarter of increasing domestic economic output as the pandemic recovery continues. (Source)

- The robust U.S. jobs market and the health of the Canadian economy support the tightening of monetary policy that Powell stated and has reiterated, which has resulted in losses for equity investors. (Source)

What’s ahead for this week?

- In Canada, following Labour Day on Monday, the economic news shift into high gear with the Bank of Canada announcing its interest rate decision at 10 am Eastern on Wednesday. Employment numbers for August will also be released.

- In the U.S., Purchasing Managers Indexes from ISM for services, manufacturing and non-manufacturing industries, July’s imports, exports, and trade balance are scheduled for release after Labor Day.

- Globally, the European Central Bank will announce its latest interest rate decision on Thursday, one day after second quarter employment and GDP data for the Eurozone is released. China’s consumer and producer inflation, and imports, exports and trade balance for August is scheduled.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.