IAIC Market Update - April 18, 2022

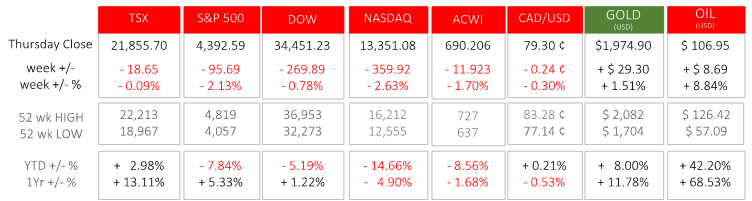

Last Week in the Markets: April 11th – 14th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- On Wednesday morning the Bank of Canada raised its interest rates again in 2022 to slow domestic inflation. The rate was increased by 0.5%, which is the largest rate increase in more than two decades. The target range for the deposit rate to the bank rate is now 0.75% to 1.25%.

- The Bank will begin quantitative tightening on April 25th where maturing Government of Canada bonds held on its balance sheet will no longer be replaced.

- “With the economy moving into excess demand and inflation persisting well above target, the Governing Council judges that interest rates will need to rise further. The policy interest rate is the Bank’s primary monetary policy instrument, and quantitative tightening will complement increases in the policy rate” (Source)

- The U.S. Consumer Price Index (CPI) rose again last month. Since February, prices for consumers rose 1.2% and in the past year prices have risen 8.5%. May 1981 was the last time the inflation rate reached this level. Like preceding months, the largest contributors were gasoline, housing, and food. Energy costs have risen 32% over the past year, and groceries are up 10% since March 2021.

- The anticipation that inflation will slow is tied directly to the energy and commodity prices which have spiked due to the invasion of Ukraine and the resulting uncertainty associated with the global political response.

- The Producer Price Index (PPI) for March sits at 11.2%, the highest recorded year-over-year increase ever recorded for American companies. (Source)

- The Federal Reserve will meet May 34 to review and adjust monetary policy, including interest rates and bond-buying, to slow the economic growth and temper inflation.

What’s ahead for this week?

- In Canada, housing starts, existing home sales, MLS home price index, new house price index and household and mortgage credit for March will be released. March’s CPI will be announced.

- In the U.S., March’s housing starts, building permits, and existing home sales will be released.

- Globally, China’s GDP, retail sales, industrial production, Japan’s CPI, industrial production, machine tool orders and trade balance, Germany’s Producer Price Index, and Eurozone CPI are scheduled for release. Also, G20 finance ministers and central bank governors meet in Washington, DC.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.