IAIC Market Update - April 24, 2023

Last Week in the Markets: April 17th – 21st, 2023

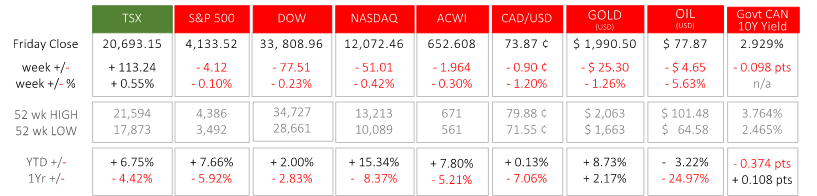

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Canada’s TSX was the only major North American index to gain ground last week. Its rise of ½% may be modest compared to some week’s gains and losses, but it outpaced its continental rivals, and all other indicators in the grid, above.

- On Tuesday StatsCan released consumer inflation numbers that showed prices have risen 4.3% in the March-to-March timeframe. One month earlier the year-over-year inflation rate was 5.2%. Much of the decline in this March’s annualized inflation rate can be attributed to the steep monthly price increases experienced in March 2022, which were 1.4%. In March 2023 consumer prices rose 0.5%. Last month food prices rose 8.9%, shelter increased by 5.4%, health and personal care rose 6.5%, while gasoline fell by 13.8%.

- On Thursday Tiff Macklem and Carolyn Rogers, Bank of Canada Governor, and Senior Deputy Governor, respectively, testified in Ottawa. The central bankers indicated that rate cuts are not expected in 2023, and a slowdown, not a recession, is expected in Canada. Some concern was expressed that further increases to government spending could contribute to inflation as the public service strike continues, and 150,000 federal workers seek higher wages. The robust job market could continue to fuel inflation, which could also delay interest rate cuts or lead to rate increases. The Bank of Canada’s overall view is that inflation will come under control and the economy will experience a soft landing. Several months will need to pass before we know whether this prediction has become reality.

Source:

StatsCan's CPI release,

Inflation Soft Landing,

CBC's take on BoC testimony

What’s ahead for this week?

- In Canada, February’s Gross Domestic Product data, and March’s new housing price index, wholesale sales, and manufacturing sales are scheduled for release. Also, the Bank of Canada will release its summary of deliberations from the last interest rate decision.

- In the U.S., the house price index, new home sales, mortgage market index and pending home sales will provide insight to the housing market for March. Consumer confidence, durable goods orders, along with Q1 Gross Domestic Product and Personal Consumption Expenditure (PCE) price index, the Federal Reserve’s preferred inflation measure, will also be reported.

- Globally, Japan will release a number of economic indicators including its Consumer Price Index, industrial production, retail sales and unemployment. In the Eurozone, German and French consumer confidence and spending, consumer inflation and Gross Domestic Product numbers will be released.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.