Dealing with Down Markets

Staying Calm When Markets are Volatile

Why Avoiding Short-Term Performance Figures Can be a Sound Strategy

In times of economic turbulence, it’s normal to feel apprehensive when you’re about to read your portfolio’s performance. And, of course, seeing the fluctuating short-term results doesn’t help. It is more important to keep your sights on the bigger picture and stay focused on your long-term investment strategy and performance. By doing so, you can navigate the choppy waters of the current economic climate more confidently and ultimately achieve your financial goals.

Typically, volatility is a short-term issue; in the long run, your long-term investment plan and confidence in your investment holdings matter. Therefore, avoiding short-term “noise” can be a good strategy. While performance is undoubtedly crucial, it should be evaluated in years, not months.

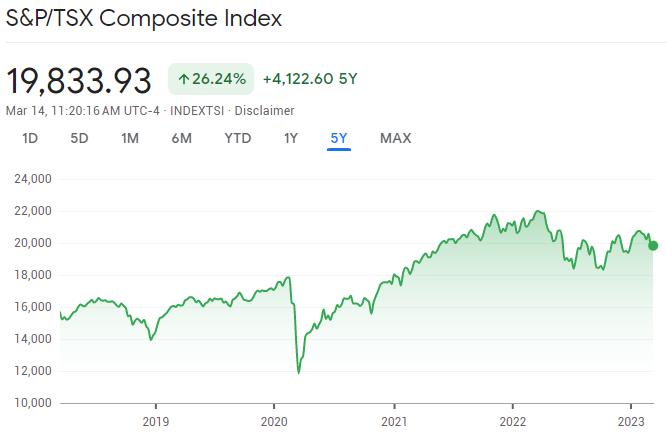

For example, take a look at it in graph terms:

The short-term view

S&P/TSX Composite Index

down 6.36% over the past 1 year

The long-term strategy

S&P/TSX Composite Index

up 26.24% over the past 5 years

Strategies for navigating market volatility

The performance figures can be an unpleasant surprise, depending on the period you are looking at or the duration being reported on your account statements.

Consider:

1.Evaluating the quality and long-term sustainability of your investments with your portfolio manager. It’s likely that your holdings are still reasonable, and no drastic changes are necessary. You may come across opportunities to refine your portfolio, but try to refrain from making significant “panic changes” that could lead to missing out on future market recoveries.

2. Updating or creating a financial plan. It’s crucial to take this step during market downturns as it can provide reassurance that your long-term financial goals are still achievable. Our experience has shown that personal financial plans often remain on track despite market downturns. Take advantage of this opportunity to update your plan and gain some much-needed reassurance.

3. Triggering a capital loss strategically if you have non-registered accounts. This can help offset a realized capital gain if you plan to sell an asset, or if you need cash or want to diversify your holdings.

4. Lowering the risk profile of your account permanently only if you cannot tolerate market volatility anymore. It may involve selling some holdings at a less-than-ideal time, but taking a hit now could be easier for you in the future. However, this should be considered a final, one-way option.

New Paragraph

Reframe your perspective

Imagine thinking about your investment portfolio as if it were your own home. This relatable comparison can help you weather market downturns with greater ease.

Unlike your monthly investment statement, you don’t receive regular updates on your home’s value nor see real estate index numbers fluctuating in real time. This lack of daily stress means that when the value of your home drops, you don’t immediately consider selling it. After all, your home is a long-term investment and a significant part of your net worth.

Similarly, selling off your stocks doesn’t make sense just because the market is down. Likewise, jumping out of the market and buying back once values have risen is not a sound strategy. Instead, stay the course and trust in your long-term investment plan.

Bottom line

– We will always have periods of volatility. It’s important to keep calm and avoid knee-jerk reactions that may jeopardize your long-term plan. Review your portfolio and strategies with your Accountant, Financial Planner and Portfolio Manager and gain the confidence you need to stay the course.

Have questions?