IAIC Market Update - December 5, 2022

Last Week in the Markets: November 28th – December 2nd, 2022

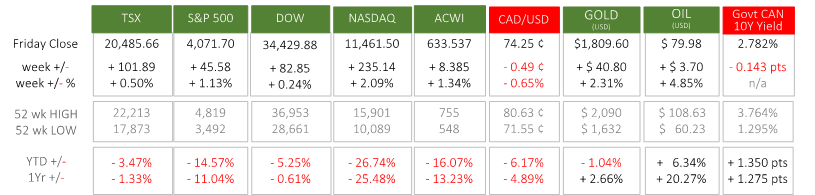

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Gross Domestic Product and jobs data heavily influenced markets, and the inferences drawn from those releases on upcoming interest rate announcements provided an additional batch of fodder for analysts.

- The Canadian economy expanded slightly during the third quarter, rising 0.7%. It was the fifth consecutive quarter of rising GDP. Oil and gas production grew 1.8% in September when a new record for crude bitumen production was set. Agricultural production rose 0.7% for the month, which is the twelfth consecutive month of increased output. (Source)

- During July, August and September 2022 the U.S. economy grew in real GDP terms at an annualized rate of 2.9%, compared with a decline of 0.6% in the second quarter. Leading the growth were increases in exports, consumer spending, and government (local, state, and federal) spending. (Source)

- Employment was little changed (+10,000) in November, and the unemployment rate declined by 0.1 percentage points to 5.1%” according to another StatsCan release. (Source)

- Total non-farm payroll employment rose by 263,000 last month in the U.S. The unemployment rate was unchanged at 3.7% as the participation rate held steady. (Source)

- GDP and jobs data show the resilience of the Canadian and, especially, the American economy as monetary policy has been tightened in 2022. The next interest rate announcements by the Bank of Canada and Federal Reserve on December 7th and 14th, respectively, are subject to speculation. The speech on Wednesday from Fed Chair, Jerome Powell, and the immediate market bump demonstrates the influence of monetary policy on equity values.(Source1,

Source2)

What’s ahead for this week?

- In Canada, October’s imports, exports, and trade balance, building permits, and industrial utilization will be announced. On Wednesday at 10 AM EST the Bank of Canada will make an interest rate decision.

- In the U.S., several economic indicators are scheduled including factory and durable goods orders, imports, exports, and trade balance, Producer Price Index (PPI), core PPI, gasoline, crude oil and heating oil inventories.

- Globally, Eurozone GDP, retail sales and employment for Q3, China’s Consumer Price Index, PPI and trade balance, Japan’s GDP and household spending will be reported.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.