IAIC Market Update - November 28, 2022

Last Week in the Markets: November 21st – 25th, 2022

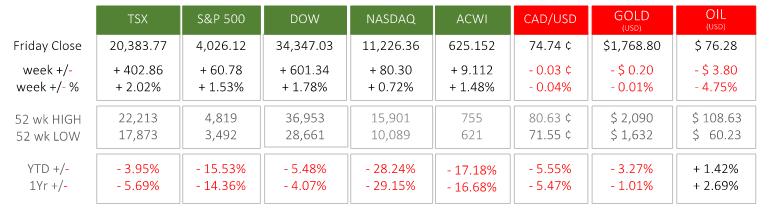

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The U.S. Thanksgiving holiday closed American markets on Thursday and Friday afternoon

- During this quieter than usual time, equities in Canada and the U.S. performed well last week as the major indices rose 1-2%. Since their closing levels of September 30th, the indexes have risen as follows, TSX 10.5%, S&P500 12.3%, Dow 19.6%, NASDAQ 6.2%. The overall increase during the past two months has been inconsistently achieved with several days of sharp peaks and narrow valleys. The sharper days of gain and loss are in contrast to the volatility index, which has fallen from 31.8 to 20.5 over the same period and is at its lowest level since August. (Source)

- The lower levels of volatility are an anticipation that central banks will begin raising interest rates more slowly. The release of the Federal Reserve’s meeting minutes showed that this sentiment is building with the Fed’s Federal Open Market Committee, who sets monetary policy. The realized prediction calmed markets, despite indications that more interest rate increases are anticipated. (Source1,

Source2,

Source3)

What’s ahead for this week?

- In Canada, Gross Domestic Product (GDP) for September and the third quarter will be released. Employment data for November will be reported on Friday.

- In the U.S., after Thanksgiving’s relatively quiet week the announcements increase to include pending home sales, house price index, mortgage applications, mortgage market index, GDP, GDP price index, consumer and personal spending, wholesale, and retail inventories. The week concludes with government, manufacturing, and non-farm payrolls.

- Globally, the FIFA World Cup continues to distract many countries from economic developments like OPEC’s production meeting, Eurozone’s consumer confidence, business climate and inflation expectation, and Consumer Price and Producer Price Indexes. China’s rapidly growing covid cases and response may foreshadow future releases from the second largest economy.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.