IAIC Market Update - February 13, 2023

Last Week in the Markets: February 6th – 10th, 2023

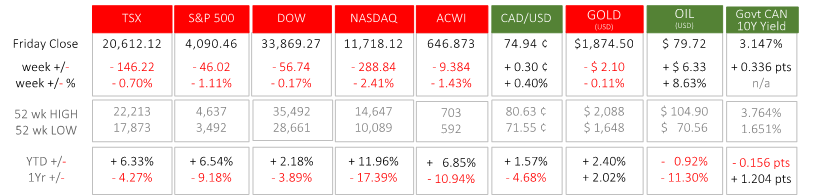

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Although equity markets lost ground last week, it has been a positive start to the year with North American indexes gaining between two and twelve percent in six weeks.

- It appears that inflation has begun to respond to interest rate actions from the Bank of Canada and the U.S. Federal Reserve. Inflation is much higher than the target of 2%, but it has fallen to about 6½%, which is down from the peaks of 8 or 9% experienced last summer. The slowing of interest rate increases, and predictions of further moderation of monetary action, is providing positive momentum for equities.

- The labour market has remained remarkably resilient. In January 150,000 and 517,000 jobs were added in Canada and the U.S., respectively. The Canadian unemployment rate has held steady at 5.0%, and just 3.4% in the U.S., which are historically low levels for both countries.

- The strong employment numbers and wage gains that have provided fuel to inflation have also allowed corporate earnings to maintain their trajectory until recently. Earnings per share (EPS) are expected to be down about 5% for the fourth quarter of 2022 in the U.S. and about 7% in Canada. The S&P 500 is tracking to report its first year-over-year decline in earnings since Q3 2022, and the TSX is predicted to deliver a slight 1.3% annual earnings gain.

- EPS predictions for the first quarter of 2023 are not buoyant. The tighter monetary policy is affecting corporate performance in the currently reported quarter, and the timelier economic news (inflation and employment) are showing improvements and strength. The markets are facing more difficult and more optimistic news simultaneously, and increased volatility may be the immediate result.

Sources:

StatsCan inflation

StatsCan employment

BLS employment

BLS inflation

FactSet S&P500

FactSet TSX

Reuters volatility

What’s ahead for this week?

- In Canada, housing starts, manufacturing sales, and wholesale sales for January are scheduled for release. The raw materials and industrial price indexes will be reported on Friday.

- In the U.S., January’s consumer and producer inflation will be announced, providing some context for Federal Reserve actions. Retail sales and inventories, capacity utilization, industrial production, manufacturing production, business inventories, building permits, and housing starts will be reported in a very busy week for U.S. economic announcements.

- Globally, the Eurozone will report fourth quarter employment, Gross Domestic Product, trade balance and industrial production data. The U.K. will release consumer and producer price indexes.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.