IAIC Market Update - February 6, 2023

Last Week in the Markets: January 30th – February 3rd, 2023

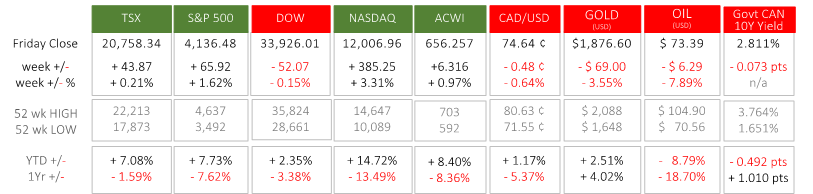

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The NASDAQ moved upward for the fifth consecutive week, the S&P 500 gained 1½%, and the TSX rose almost the same amount as the Dow lost. According to FACTSET half the S&P 500 companies have reported their most recent quarterly earnings, and 70% have exceeded earnings expectations, which is below the 5-year average or 77%. (Source)

- Major news came from the U.S. Federal Reserve on February 1st. “The Fed” echoed previous sentiment from the Bank of Canada by raising its benchmark interest rate, the federal funds rate, by 25 basis points (¼ percent) to a range of 4.5% to 4.75%. Over the same period the Bank of Canada has raised its policy interest rate by the same amount. This was the smallest increase since March 2022, when the Fed began increasing interest rates to combat inflation. Between then and now, the Fed has delivered increases of 50 basis points twice, and 75 basis points four times. (Source1, Source2)

- The return to a smaller increase suggests that inflation may have begun to respond to these increases, and the end of rate increases may be approaching. The difference in wording in the accompanying press release, that “the Committee would be prepared to adjust the stance of monetary policy” versus December’s “the Committee anticipates that ongoing increases in the target range will be appropriate” supports the smaller rate increase. (Source1, Source2, Source3)

- Earlier in the week Canadian Gross Domestic Product (GDP) numbers were released by StatsCan that showed our economy edged up 0.1% in November. Gains by services industries were mostly offset by decline in goods production. The early results for December show that GDP was unchanged. (Source)

What’s ahead for this week?

- In Canada, December’s imports, exports, and trade balance will be released on Tuesday, and employment data (full and part-time employment, participation, and unemployment) will be reported on Friday.

- In the U.S., a quieter week delivers trade balance, consumer credit, wholesale trade, and the federal government’s budget balance.

- Globally, in the Eurozone, retail sales, construction data, and German industrial production are the most important anticipated reports. In Asia, China’s latest CPI and Japan’s household spending are scheduled.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.