IAIC Market Update - January 30, 2023

Last Week in the Markets: January 23rd – 27th, 2023

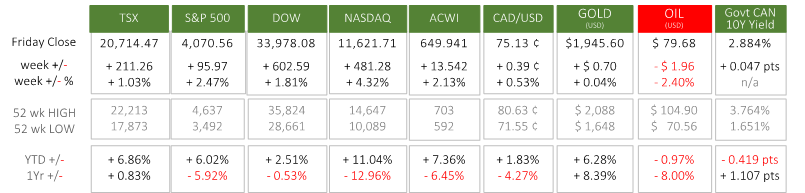

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The Bank of Canada released its latest monetary policy on Wednesday morning, raising the policy interest rate by 25 basis points to 4.50%. Since March 2022 Canada’s central bank has increased this rate from its effective lower boundary of 0.25% by 4.25%.

- Some of the criteria underlying the interest rate decision includes Canadian and American consumer and producer inflation, the jobs market (job creation, total employment, labour force participation and unemployment), and economic conditions, globally. The Bank expects domestic inflation to fall back to about 3% this year and near 2% in 2024 as energy prices continue to fall and restrictive monetary policy continues to reduce demand, which will eventually slow the demand for workers. The easing of restrictions in China promotes additional economic growth there, and the Bank of Canada projects that the global economy will grow by 2% this year and 2½% in 2023.

- The next scheduled monetary policy release by the U.S. Federal Reserve is February 1, and indications from their leadership of additional rate increases must be included in our central bank’s reasoning.

Bank of Canada release, press conference and Monetary Policy Report

What’s ahead for this week?

- In Canada, November’s Gross Domestic Product (GDP) data will be announced. An improvement from its 0.1% decline in October is expected, but the interest rate increases imposed by the Bank of Canada since March are anticipated as a significant deterrent to economic growth.

- In the U.S., the Federal Reserve’s Federal Open Market Committee (FOMC) will release a monetary policy update on Wednesday afternoon. The size of an interest rate increase has been one of the most popular points of debate for business and economic news. January’s non-farm payroll report portray the health of the jobs market, which is the companion to inflation as the Federal Reserve’s twin mandates.

- Globally, German GDP, trade balance, import price index, producer price index (PPI), retail sales, and consumer price index (CPI), French PPI, and Italian CPI will be reported. The CPI and PPI for the entire Eurozone will be reported in aggregate as the European Central Bank ponders additional rate increases.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.