IAIC Market Update - March 8, 2021

Last Week in the Markets: March 1st - 5th, 2021

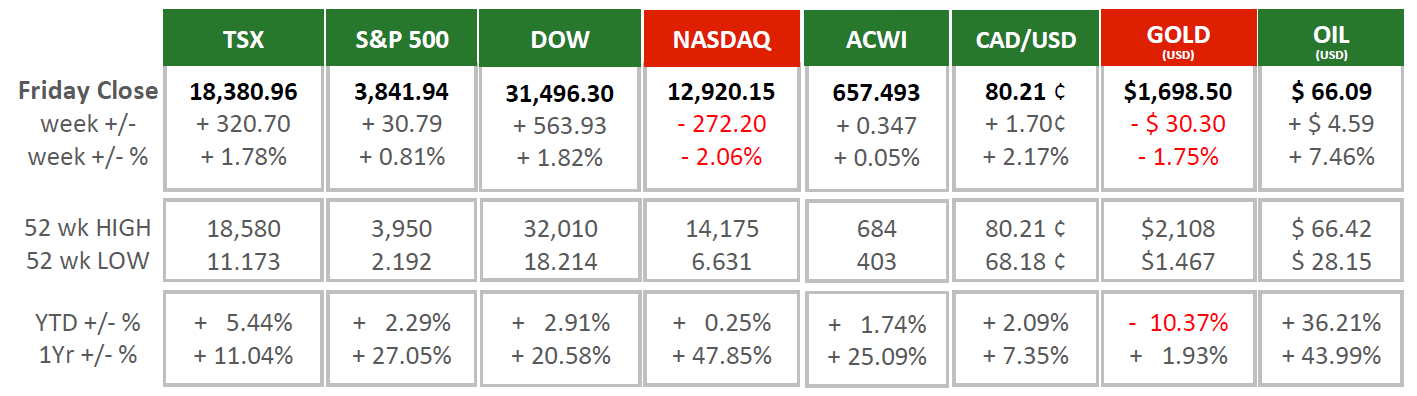

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- The markets performed well last week.

- StatsCan announced Canadian GDP was higher than expected for December and the fourth quarter of last year.

- Our expanding economy seemed to be prevailing in small measures despite the negative restrictions that have been put in-place to control the pandemic.

- The rise in the price of oil help boost the Energy sector, the second largest sector comprising the TSX index.

- Financials, the largest sector of the TSX, continued to benefit from last week’s strong bank earnings that totaled nearly $14 Billion and from rising bond prices. Higher bond rates typically raise earnings for Financials, and the high earnings could be poised to increase should the pandemic and its economic effects be lessening.

- On Friday the U.S. jobs report for February was released.

- Many of the measures remained unchanged although 379,000 non-farm jobs were added.

- The unemployment rate held firm at 6.2%, 10 million Americans were unemployed.

- One year ago, prior to the pandemic, the unemployment rate stood at 3.5% with 5.7 million unemployed. The groups that are taking the brunt of pandemic induced job loss are African Americans and Hispanics. Nearly 2 million have had their full-time jobs downgraded to part-time employment. The employment numbers will continue to be a representation of economic recovery. (Source)

What’s ahead for this week?

- In Canada, it will be our turn for February employment numbers. On Wednesday the Bank of Canada will release its latest interest rate decision. Comments by Tiff Macklem, Bank of Canada Chair, will be closely monitored and analysed as inflation fears and bond rate uncertainty have risen.

- In the U.S., the focus of economic releases will be inflation for February with the release of the Consumer and Producer Price Indices (CPI and PPI, respectively). Inflation as a positively corelated indicator of economic growth is the measure that central bankers are watching to guide any interest rate increases. None are expected in the near term but noting inflation’s movement could provide some hints of interest rate changes.

The latest details from the Canadian Federal Government on stimulus and economic assistance are available here.

The latest details of the current Canada’s Covid-19 Economic Response Plan are available

here.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.