IAIC Market Update - May 31, 2021

Last Week in the Markets: May 24th - 28th, 2021

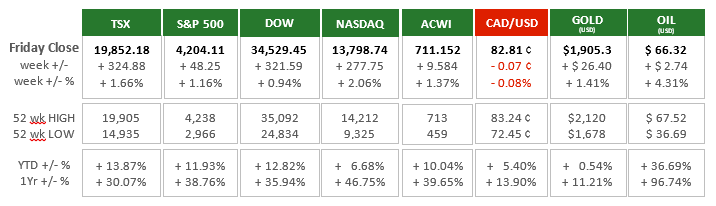

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indices delivered another week of strong returns. The Canadian dollar was the sole declining indicator in the grid (above), but only just slightly. Gold moved back into positive territory for its Year-to-Date returns as oil continued its rise.

- For the TSX, the major Canadian banks led the Financial sector, and the Financial Sector led the entire index higher on its strength. The Bank of Montreal, CIBC, Royal Bank and TD announced results that exceeded expectations for the latest quarter. Most of the increased performance has been attributed to declining loan losses and the accompanying reserves necessary to cover unpaid debt. The default rate on outstanding credit is a strong indicator of the health of the overall economy.

- American firms have also delivered impressive quarterly earnings. According to FactSet and Standard & Poors analytics, 86% of U.S. public companies have beaten analyst profit projections, and the expected profits are more than 20% than anticipated. The explanation is that consumer and business demand is rising quickly across the U.S. as restrictions are relaxed more quickly than in other countries.

- In the short term the alignment of corporate profits and equity prices should provide some predictability for investors. Early emergence from the pandemic had the promise of recovery driving stock prices, it appears that much of that promise is being delivered and markets are continuing to react positively.

What’s ahead for this week?

- In Canada, first quarter real Gross Domestic Product (GDP) will be announced. The annual growth rate is expected to be almost 7%. On Friday employment data for May will be released, which will show the effects of the latest restrictions to combat the pandemic in various regions across the country.

- In the U.S., the markets are closed to observe Memorial Day. Once the business week begins, construction spending and Markit and ISM’s purchasing managers indices are scheduled for release.

- Globally, Japan will release its industrial production, retail sales, household spending and consumer confidence numbers. Germany will release its inflation, which as the largest European economy could influence future decisions for the European Central Bank. Germany will also release retail sales and unemployment numbers.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.