TFSA or RRSP? Take Your Pick

Should you invest in a Tax Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP)?

For most, the answer is “a bit of both.” Both plans are registered and provide a way to save for your retirement and other future lifestyle expenses. Current income levels play a large role in answering the question and both plans allow for your savings to remain tax sheltered while inside the plan. It’s also a good idea to ask yourself if you have a known short or medium-term need (under five years), or long term retirement needs.

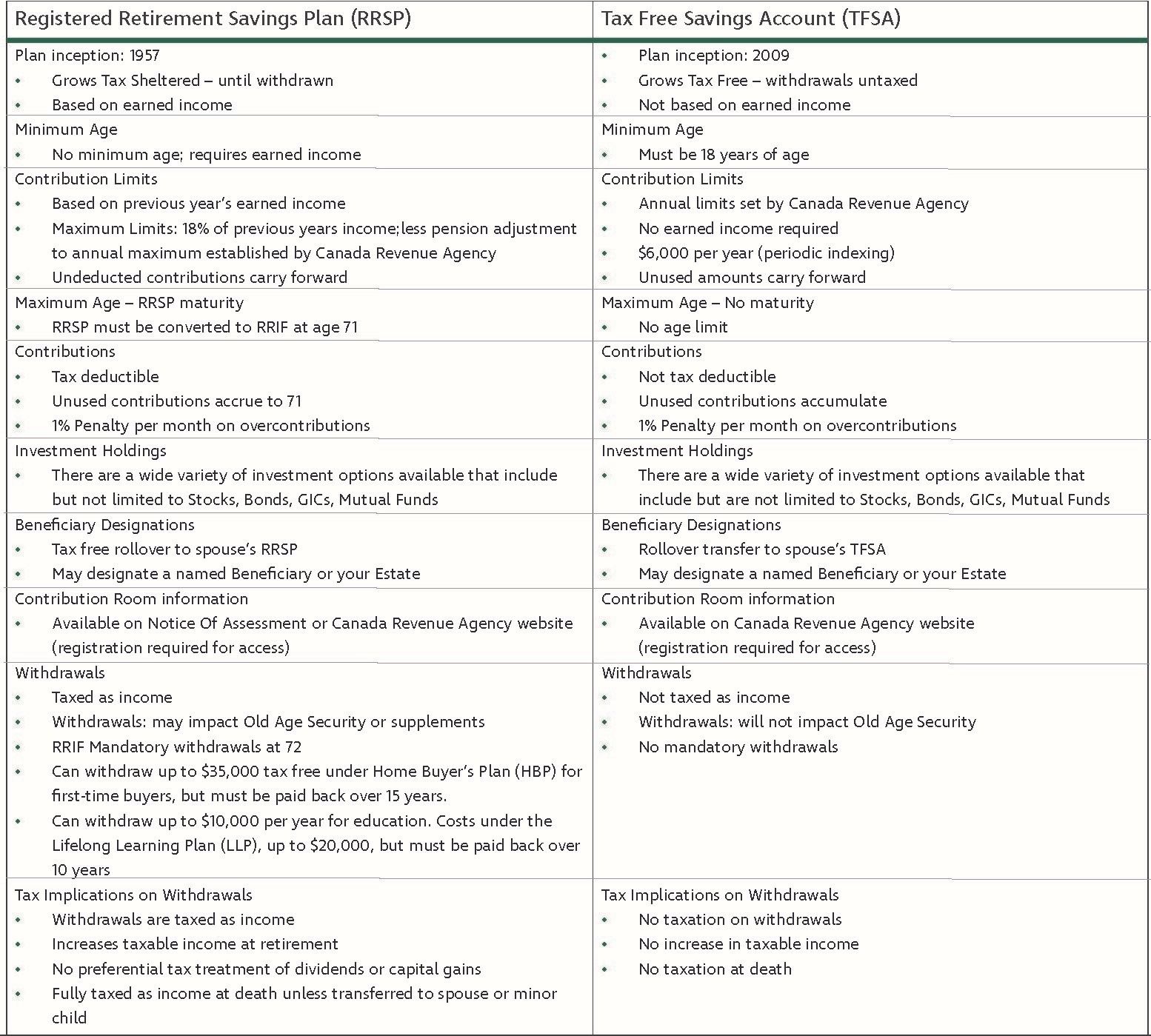

For more details review the key differences and pros and cons of each below:

What are the key differences?

What are the Pros and Cons?

Registered Retirement Savings Plan (RRSP)

PROS

- Immediate tax benefit on contribution

- Funds can be deposited into a Spousal RRSP to help split income and thereby lower taxes in retirement

- Enforces savings discipline because of the tax implications on withdrawals

- At death, RRSPs can be transferred to the surviving spouse tax free

CONS

- The investor will have to pay tax upon withdrawal, and a minimum, ten percent withholding at source is required with a maximum thirty percent for larger amounts

- Withdrawals are subject to your marginal tax bracket at any time (other than for a first-time home buyer plan or you or your spouse are attending school)

- Withdrawals result in permanent loss of contribution room

- Unless there is a surviving spouse or dependant minor child, the entire balance of an RRSP, valued on the date of death, is taxed as income on the deceased’s terminal return. If the balance is large enough, it can generate significant tax liability for the heirs.

Tax Free Savings Account (TFSA)

PROS

- Funds can be withdrawn from a TFSA at any time without any tax penalties

- TFSA spans a lifetime, does not present any tax liability at death unlike an RRSP

CONS

- Funds can be withdrawn from a TFSA at any time making withdrawals tempting; investors must rely on self-discipline

- Repayments of withdrawals that put an individual over the maximum contribution are subject to severe penalties; investors must self-monitor, and wait until the following year

Bottom Line...

With so many different options available, choosing where to invest your savings can be confusing. Just as diversity is key for a successful investment portfolio, the same holds true for investment vehicles, like RRSPs and TFSAs.

Both have important functions within an overall savings strategy. In an ideal situation, you’ll want to utilize both within your portfolio.

If you would like to discuss your options further, or if you have questions contact our office. We are ready to help you make the right decision.

Take your pick!

Contact a Ward & Uptigrove Wealth Management representative today at (519) 291-4803, or by email WealthManagement@w-u.on.ca, to discuss your options or to learn more!

CONTACT US

Ward & Uptigrove