IAIC Market Update - May 8, 2023

Last Week in the Markets: May 1st – 5th, 2023

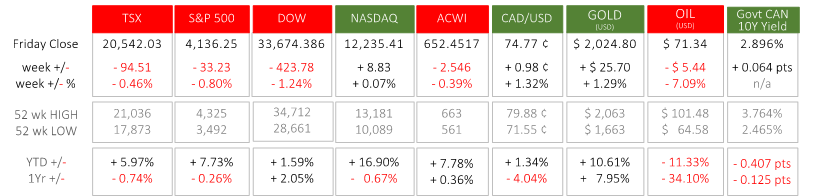

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indexes lost value from Monday to Thursday before rallying on Friday when the TSX rose 1½% and the NASDAQ jumped 2¼% with the S&P 500 and Dow both improving by about 1¾% final day of the week. The losses had been about 2-3% prior to Friday’s rally.

- Friday also brought the latest Canadian employment data from StatsCan. Employment rose by 41,000 in April, all in part-time work. The unemployment rate has been unchanged since December 2022 and remains at 5.0%. The slowing of full-time employment growth is a result of prior monetary actions undertaken by the Bank of Canada to temper demand.

- Linked to employment and current rounds of interest rate increases, the U.S. is lagging behind Canada. On Wednesday the U.S. Federal Reserve raised interest rates by ¼ percent (25 basis points) to a range of 5% to 5¼% for the federal funds rate. In the press conference that followed the interest rate announcement, Fed Chair, Jerome Powell, indicated that the timing of a rate-cut was not known, and that the current conditions do not favour a reversal of the current path.

- On Thursday the European Central Bank (ECB) raised its benchmark interest rates by the same amount ¼ percent (25 basis points). Price stability (controlling inflation) is the primary goal of the ECB’s interest rate policy, just as it is for the Bank of Canada and Federal Reserve. All three institutions have a 2% target inflation rate as their goal.

- The next opportunity for the ECB, Bank of Canada, and Fed to adjust its monetary policy is scheduled for June 5th, June 7th, and June 14th, respectively. Several weeks will elapse before the opportunity for monetary policy from these three bodies to further align arrives.

Source:

StatsCan release,

Fed release,

CNBC and Fed decision,

ECB release

What’s ahead for this week?

- In Canada, a very light week for economic announcements brings March’s building permits on Wednesday, and not much else of note.

- In the U.S., wholesale inventories and sales, and monthly and year-over-year Consumer Price Index (CPI), Producer Price Index (PPI), and Import and Export Price Indexes will describe the inflation situation for Americans and American firms.

Globally, China will release its CPI and PPI, and imports, exports, and trade balance. In Europe, France and Germany will reveal their consumer inflation.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2023 Independent Accountants’ Investment Counsel Inc. All rights reserved.