IAIC Market Update - November 29, 2021

Last Week in the Markets: November 22nd - 26th, 2021

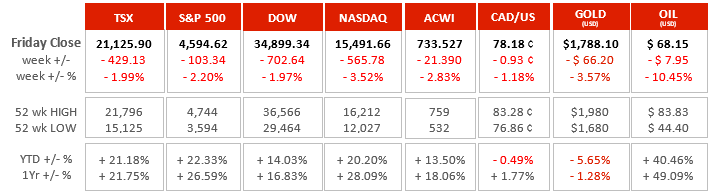

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indices dropped more than 2% on Friday and drove the grid above to another pandemic-related “all red” week due to fears that renewed domestic restrictions and lockdowns, as well as curtailing the movement of people, raw materials and finished goods could damage the pace of economic recovery. Global equities represented by MSCI’s All Country World Index (ACWI) was down almost 3% for the week. The price of West Texas Intermediate (WTI) oil fell by more than $10/barrel and more than 13% on Friday. Gold held steady on Friday, gaining $1.20 per ounce, which demonstrated its value as a ‘safe haven’, at least for a day.

- These one-day losses (except for gold) followed the observance of Thanksgiving across the U.S. and continued the tradition of a light trading day with volumes down more than 20% compared with the previous Friday. This would have been the second consecutive “all red” week had S&P 500 lost value last week. Two consecutive weeks where all our indicators have lost value has not happened in 2021 and not since the darkest days of the pandemic.

- Despite the recent setbacks equity indices in North America are up 14-22% in 2021 and 17-28% from a year ago.

What’s ahead for this week?

- In Canada, building permits, industrial product and raw materials price indexes for October will be released. November’s employment report is scheduled along with real GDP for the third quarter.

- In the U.S., October’s pending home sales, construction spending, factory orders, wage rate and the employment report for November will be announced.

- Globally, Germany and the Eurozone will announce their latest data on employment, inflation and consumer confidence. OPEC+ will conduct another meeting in response to the recent variant news from Africa and the release of strategic oil reserves by several governments to lower the price of oil to soften inflation.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.