IAIC Market Update - April 25, 2022

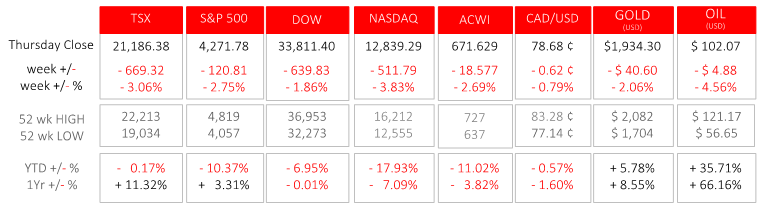

Last Week in the Markets: April 18th – 22th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- North American equity indices started the week flat; rose on Tuesday and Wednesday before tumbling on Thursday and Friday. The NASDAQ dropped nearly 4% for the week. Friday saw the other indices lose between 2%-3% and 3%-4% for the week. The reasons coalesce around inflation and interest rates:

- StatsCan released Consumer Price Index (CPI) data for March on Wednesday. Prices increased 1% during over the past month and 6.7% over the past year. It is the largest, annual reading in 31 years. Gasoline has been a major contributor to the growing rate of inflation after rising more than 19% since February 1st. Rising inflation is further justification of the Bank of Canada’s interest rate increases. (Source)

- Fed Chair, Jerome Powell, indicated that inflation may have peaked in March as wages have increased, housing costs have climbed rapidly, and service industry price jumps amid continued supply chain problems. (Source)

- The Fed’s moves are making equities less attractive than bonds and other fixed income investments. The yield on 10 Year U.S. Treasuries has moved higher recently, doubling since early December, and gaining nearing 1½ points in the last five weeks. (Source)

- The Federal Reserve next meets to discuss interest rates on May 3-4.

- Additionally, the invasion of Ukraine continues to interrupt agricultural production and increases the threat for oil and gas shortages that has oil over $100/barrel despite a drop last week.

What’s ahead for this week?

- In Canada, February’s Gross Domestic Product (GDP) and survey of employment, and March’s wholesale trade, and manufacturing sales will be announced.

- In the U.S., announcements of quarterly earnings will include results from Coca-Cola, GE, UPS, Alphabet, Amazon, Apple, Microsoft, McDonald’s, Exxon Mobil, and Caterpillar. Durable goods and core orders, new home sales, pending home sales, goods trade deficit, and wholesale and retail inventories will be released.

- Globally, Japan’s department store sales, jobless rate and monetary policy from its central bank, Germany’s GDP, business climate, consumer confidence and CPI, Eurozone GDP, CPI and money supply are scheduled for release.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2022 Independent Accountants’ Investment Counsel Inc. All rights reserved.